site.btaUPDATED Revenue Agency Checks Over 800 Retail Businesses on Bulgarian Black Sea Coast

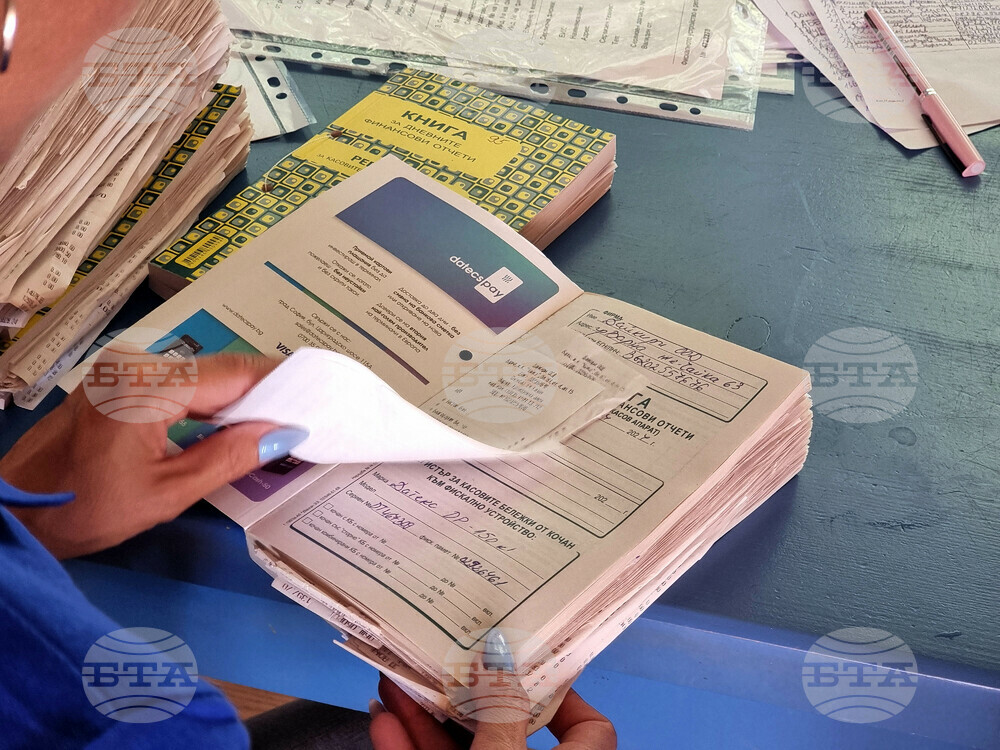

The National Revenue Agency (NRA) completed over 800 checks of retail businesses at the Bulgarian Black Sea coast, the NRA said on Saturday. Failure to issue a receipt is still one of the most frequent violations committed by vendors on the Northern Black Sea coast, Lora Georgieva, chief communications expert at the NRA - Varna, said on Saturday after completing an inspection in one of the restaurants on the promenade in the seaside town.

She pointed out that since June 28, inspectors from the regional directorate of the NRA have carried out more than 320 inspections. The focus this summer remains on the activities of the places that attract the most tourists - restaurants, amusement parks, and car parks, Georgieva said. According to her, every tenth of the checks carried out results in finding some violation.

Inspectors often find discrepancies between the reported turnover and the amount of cash on hand, Georgieva said. She clarified that it is not always a question of concealing turnover. If at the beginning of the day, the trader has not entered an initial amount available in the cash register, there will always be differences, the expert said. According to her, the same is true if during the day money is taken from the cash register to pay for some goods and it is not recorded later.

Georgieva noted that this year customers have the right to withhold their payment if they do not receive a fiscal or system receipt. Non-payment of the bill is valid until a fiscal receipt is received. Customers of restaurants should not accept a service receipt, which is an internal document and is not reflected on the fiscal device, Georgieva said. In her words, the internal receipt is without the necessary details - the name of the company, its address, its BULSTAT number, and the QR code.

The expert also said that during the same period last year, inspectors had carried out more than 500 inspections, during which they had found more than 140 violations. The fiscal discipline of traders is improving, Georgieva said, stressing that the aim of the revenue agency is not to punish, but to make the owners of the outlets work, observing the law.

Bureaucracy is heavy, but it is easy to work with the NRA if the documentation is kept accurately, added Vilian Vassilev, owner of a coastal restaurant and marketing director of the restaurant, which was inspected on Saturday. According to him, problems stem from legislation because it is lagging behind and does not reflect the entry of new technologies. In the computer age, restaurants write endless reports on paper, Vassilev said, stressing that changes in legislation are necessary.

He also said that issues with staffing are still on the agenda. The kitchens of the restaurants he is involved with are trilingual as there are workers from Uzbekistan, Kyrgyzstan and India. However, the waiters are Bulgarians, including Bessarabian, to make it easier for the customers, Vassilev added.

/YV/

news.modal.header

news.modal.text