site.btaUnited Bulgarian Bank Raises GDP Growth Forecast for 2025 to 2.9%

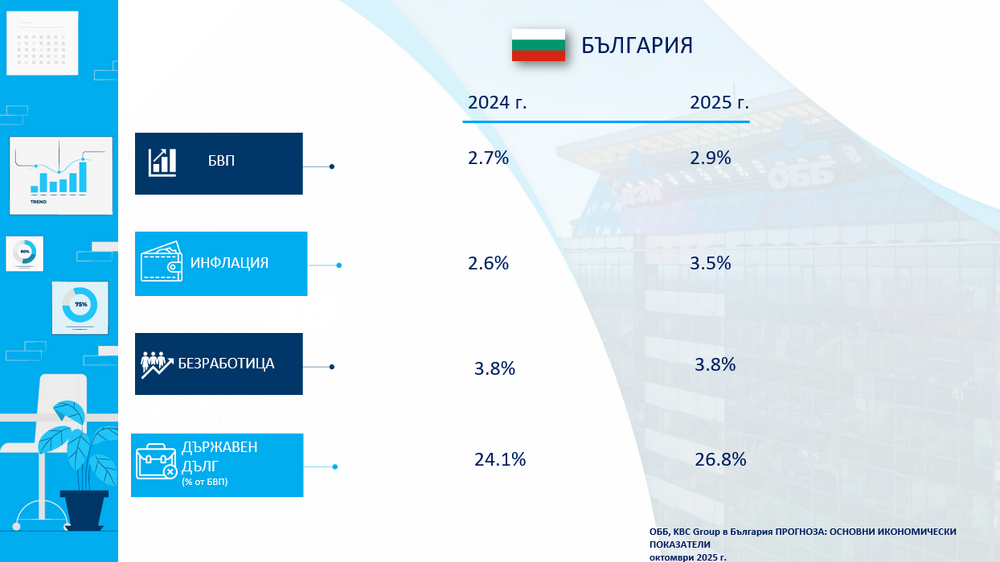

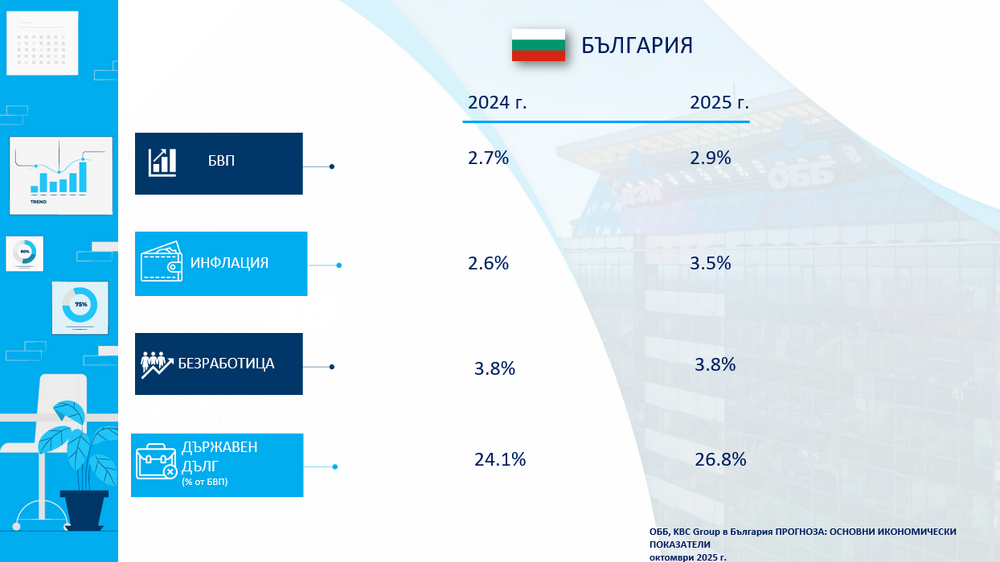

United Bulgarian Bank (UBB) has increased its forecast for Bulgaria’s gross domestic product (GDP) growth in 2025 from 2.8% to 2.9%, the bank announced on Tuesday. The forecast remains conservative. The main reason for the revision is the strong impact of budgetary spending on GDP growth in the first half of the year, which makes growth levels above 3% unsustainable, according to an analysis by UBB Chief Economist Emil Kalchev.

In the first half of 2025, the GDP achieved significant growth of 3.3%. “On the demand side, final consumption was the main driver of economic activity, increasing by 8% with a dominant relative share of 80.9% in the GDP structure. Investments grew even faster, reaching a 9.5% year-on-year increase, and based on their more than four times smaller share of 17.9%, they also provided stable support to growth,” Kalchev said. Against this background, exports contracted by 4.1%, while imports increased by 2.3% during the half-year period.

On the production side, construction and services formed the basis of growth. “Construction increased its output by 7.7%, but its impact on GDP dynamics was not particularly strong due to its modest relative share of 3.7%. Although slower than construction, services also grew significantly, by 4% year-on-year, mainly driving the economy upward due to their huge share of 64.5% in GDP,” Kalchev added. Meanwhile, agriculture and industry recorded declines of 2% and 3.2%, respectively.

In August, the harmonized index of consumer prices rose by 3.5% year-on-year, while consumer price index (according to national methodology) remained at a high level of 5.3%. Core inflation (excluding food and fuel) also accelerated to 3.6%. According to UBB, the main driver behind the rapid price increases is the continued double-digit growth of wages in the country. This clearly generates heightened inflation expectations among households and businesses, which materialize into accelerated actual inflation. The decision to introduce the euro has strengthened inflationary expectations but is not the primary cause.

According to the latest data from the National Statistical Institute (NSI), in the second quarter of 2025, housing prices increased by 15.5% compared to the same period last year, with their growth rate slightly accelerating by 0.4 percentage points compared to the first quarter. “Intense demand for housing, especially in major cities, the liquidity and professionalism of the banking sector, as well as the psychological dynamics around the euro, have driven the rise in property prices,” Kalchev said.

Factors expected to continue stimulating demand include rapid wage growth, historically low mortgage interest rates, relatively limited household investment options, migration to the capital and large cities, as well as national investment psychology. At the same time, the quality of new housing offered is significantly higher, which also suggests higher prices.

“After joining the eurozone, the intense emotions and fears driving the market upwards will gradually weaken, while the broader monetary and investment openness of the country will create additional investment opportunities for households. High prices naturally cool demand, and the accelerating supply is also expected to slow price growth in the medium term,” Kalchev added.

/MR/

news.modal.header

news.modal.text